The 5 W's of Medicare

Who is Eligible for Medicare?

Anyone age 65 or older who has participated in Social Security, Railroad Retirement System or employees of Federal, State or Local Governments or who spouse has participated.

Individuals under age 65 that have been awarded Social Security or Railroad Retirement Disability after 24 months.

Those disabled due to ALS (Lou Gehrig’s Disease).

Individuals with End Stage Renal Disease (ESRD).

What is Medicare?

Original Medicare (part A & part B) Medicare coverage requires copays, coinsurance and deductible payments that are the responsibility of the individual. Which is why you need to get additional coverage.

When do I enroll in Medicare?

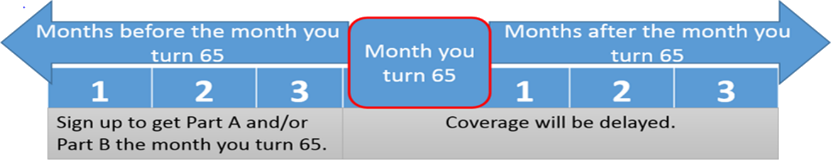

Initial Enrollment Period (IEP) 7-month period when your turn 65 and first become eligible for Medicare.

Annual Enrollement Period (AEP) Oct 15-Dec 7th the 1 time of year every senior can make a change to their plan for the next year. Coverage begins Jan 1

Special Enrollment Periods (SEP) Dates are specific to the individuals situation. Most common SEP's occur when someone moves outside of the plans service area, or loss of employer coverage due to a spouse or themselves retiring.

Where do I sign up for Medicare?

Clients sign up for Medicare at SSA.gov, call 1-800-772-1213, or make an appointment at the local office.

When it's time to add additional coverage we can get together via Zoom, phone, my office, or your house.

Why should I work with Sage Largesse for my Medicare coverage?

People work with us for many reasons. The biggest reason is our knowledge and experience, 14+ years. A close 2nd is that we're independent.

What this means is, we are not beholden to one company over another, we find the right company and plan based on our clients need. We also do NOT charge for our time, we get compensated by the companies we decide to place the business with. We get paid the same whether we sell a $0 premium plan or the most expensive, so we will not try to upsell or over-insure you. We are big believers that you can spend your money better than the insurance companies can.

The last major reason why clients decide to work with us is because we're local, not an 800 number, you'll see me in the grocery store or at the movies. My contact information is to my cell phone.